Cheyenne Federal Credit Union: Reliable Financial Providers for Your Needs

Cheyenne Federal Credit Union: Reliable Financial Providers for Your Needs

Blog Article

Open the Benefits of a Federal Credit Scores Union Today

Check out the untapped benefits of lining up with a government lending institution, a calculated monetary move that can reinvent your banking experience. From special participant benefits to a solid area principles, federal cooperative credit union supply an unique method to financial services that is both customer-centric and economically advantageous. Discover just how this different banking version can give you with an unique viewpoint on monetary wellness and lasting security.

Advantages of Signing Up With a Federal Lending Institution

Signing Up With a Federal Lending institution uses people accessibility to numerous monetary solutions and benefits not generally offered at typical financial institutions. Among the key benefits of signing up with a Federal Cooperative credit union is the focus on participant complete satisfaction instead than creating revenues for investors. This member-focused technique typically converts right into much better customer care, as Credit scores Unions focus on the requirements of their participants most of all else. Furthermore, Federal Cooperative credit union are not-for-profit organizations, permitting them to provide affordable interest rates on interest-bearing accounts, car loans, and credit score cards.

One more advantage of signing up with a Federal Credit Union is the sense of neighborhood and belonging that members usually experience. Cooperative credit union are member-owned and operated, implying that each participant has a risk in the company. This can promote a sense of loyalty and depend on between members and the Credit score Union, causing an extra customized financial experience. Finally, Federal Lending institution usually offer monetary education and sources to assist participants improve their monetary proficiency and make informed decisions concerning their cash.

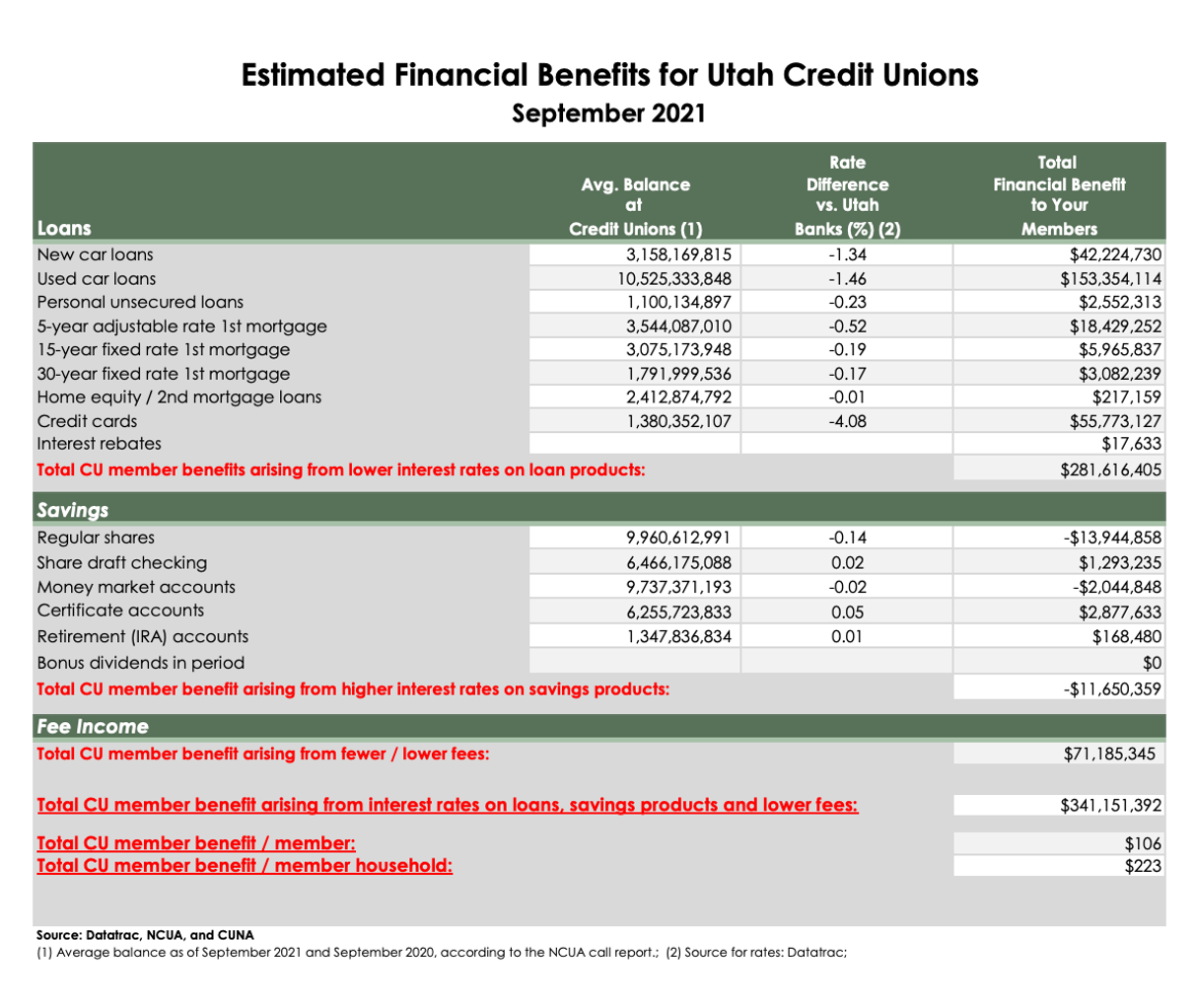

Reduced Costs and Affordable Prices

Additionally, federal credit report unions are understood for providing affordable interest prices on cost savings accounts, finances, and credit history cards. By supplying these competitive prices, government debt unions prioritize the economic wellness of their participants and aim to aid them achieve their economic goals.

Personalized Client Service

A characteristic of federal credit scores unions is their dedication to giving personalized customer support tailored to the private needs and preferences of their participants. Unlike typical financial institutions, government cooperative credit union prioritize building strong partnerships with their members, aiming to offer an extra personalized experience. This customized strategy indicates check out here that participants are not simply seen as an account number, however rather as valued individuals with Get the facts distinct financial goals and conditions.

One way government cooperative credit union deliver individualized customer care is via their member-focused approach. Representatives make the effort to understand each participant's particular financial situation and offer tailored solutions to fulfill their needs. Whether a participant is aiming to open a new account, look for a lending, or seek economic suggestions, government credit report unions aim to provide tailored assistance and support every action of the means.

Community-Focused Initiatives

To further boost their impact and link with members, federal credit score unions actively participate in community-focused efforts that add to the well-being and advancement of the areas they offer. These initiatives typically consist of economic education and learning programs targeted at encouraging people with the knowledge and abilities to make enlightened decisions about their funds (Cheyenne Credit Unions). By supplying workshops, workshops, and one-on-one counseling sessions, cooperative credit union aid neighborhood members enhance their economic literacy, handle financial obligation properly, and plan for a secure future

Moreover, federal credit unions frequently join neighborhood occasions, sponsor neighborhood tasks, and support philanthropic causes to address details needs within their service areas. This participation not only demonstrates their commitment to social duty but also strengthens their connections with members and fosters a feeling of belonging within the community.

Through these community-focused initiatives, government lending institution play an essential role in advertising economic incorporation, financial stability, and overall prosperity in the areas they run, inevitably producing a positive impact that extends past their typical financial solutions.

Optimizing Your Membership Benefits

When aiming to make the most of your membership advantages at a lending institution, understanding the range of sources and services readily available can considerably enhance your financial health. Federal credit score unions use a range of advantages to their members, consisting of affordable rates of interest on cost savings accounts and finances, reduced costs contrasted to typical financial institutions, and personalized client service. By taking complete advantage of these benefits, members can improve their economic stability and achieve their objectives better.

In addition, participating in monetary education and learning programs and workshops provided by the credit history union can help you enhance your money administration abilities and make even more educated choices concerning your more information monetary future. By proactively involving with the sources available to you as a member, you can open the full capacity of your connection with the debt union.

Verdict

To conclude, the advantages of signing up with a government lending institution consist of lower charges, affordable prices, personalized customer support, and community-focused initiatives. By optimizing your membership benefits, you can access price savings, tailored solutions, and a feeling of belonging. Think about opening the advantages of a government lending institution today to experience a monetary organization that focuses on participant contentment and provides an array of sources for financial education and learning.

Furthermore, Federal Debt Unions are not-for-profit companies, allowing them to offer competitive interest rates on cost savings accounts, fundings, and credit history cards.

Federal Debt Unions frequently give monetary education and learning and resources to aid members improve their monetary proficiency and make educated decisions about their cash.

Report this page